Legislative guidance and support is one of the central tenets of the ICCFA’s mission. The ICCFA does what no cemetery or funeral home can do alone: we speak for the entire deathcare profession. Congress looks to us when an expert on our industry is needed. The ICCFA regularly interacts with numerous federal agencies, including the Federal Trade Commission, the General Accounting Office, the Internal Revenue Service, the Occupational Safety and Health Administration and the Environmental Protection Agency, as well as the state and federal courts.

The ICCFA keeps members informed of relevant legislative and legal activities through several vehicles, including “Washington Report,” a column that appears monthly in our publication, Memento Mori, and in Wireless, our bi-weekly e-mail newsletter.

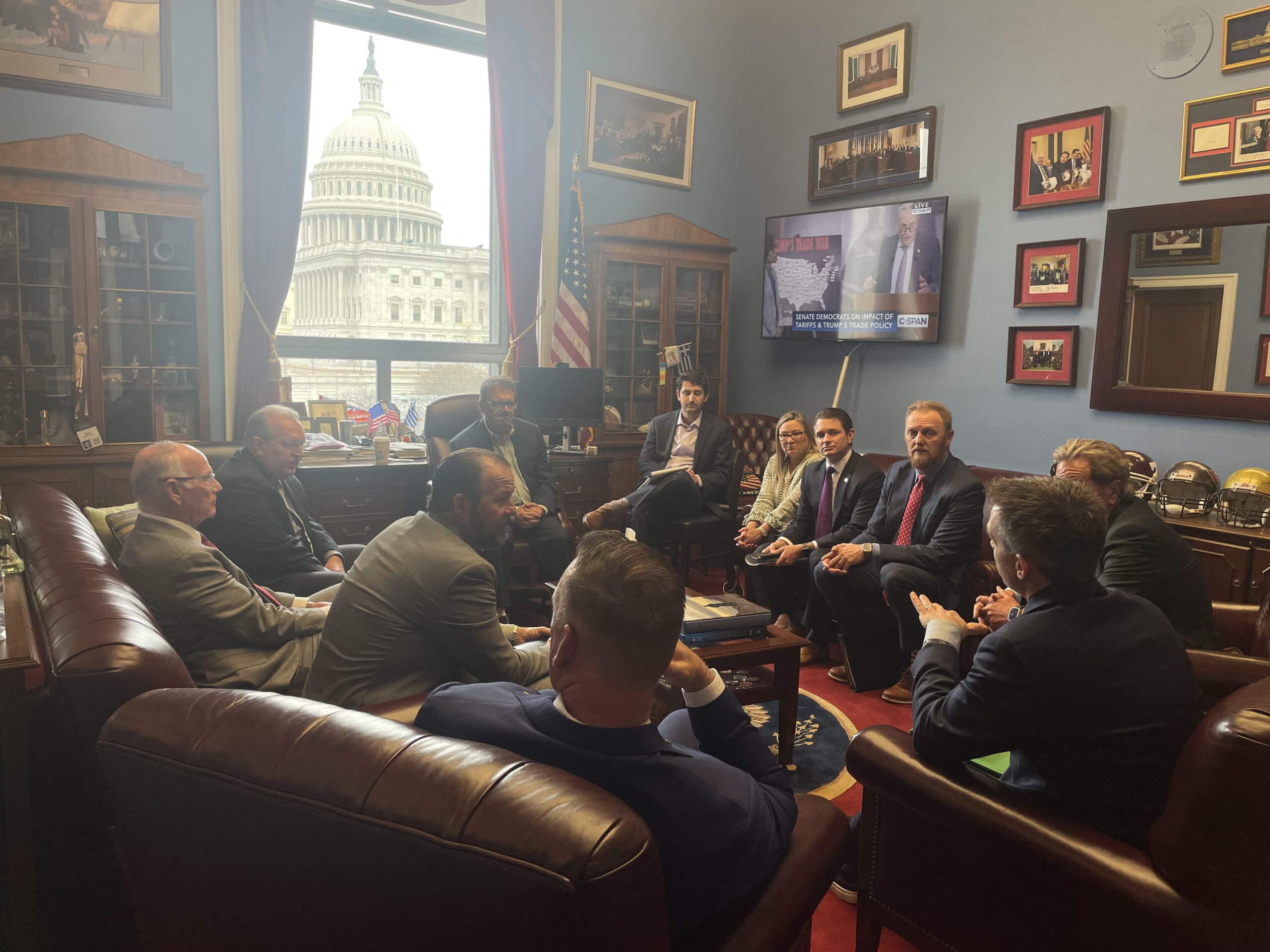

ICCFA’s Advocacy in Action

ICCFA Advocacy Updates

Political Action Committee (PAC)

A PAC is a committee operating under federal election regulations, which pools together individual contributions and collectively contributes them to key candidates for Congress and the Senate. The ICCFA PAC was established in 2003 and is a bipartisan multicandidate federal political action committee affiliated with the International Cemetery, Cremation and Funeral Association and registered with the Federal Election Commission. The ICCFA PAC provides the Association with the ability to be a stronger, more unified force in the political arena. Because there is strength in numbers, the ICCFA PAC is more effective than individual contributions.

Eligible donors to the ICCFA PAC are private individuals or other PAC funds. The maximum annual donation that can be made to the ICCFA PAC is $5,000.

To make an individual contribution to the ICCFA PAC, sign in to the ICCFA member portal at users.iccfa.com, then click on “Members Home Page”.

ICCFA Legal Fund

The ICCFA also operates a Legal Fund. One of the major benefits of membership is a year-round presence on Capitol Hill, monitoring all legislative and regulatory activities in Congress, with the agencies, and in the courts. Donations allow the ICCFA to continue to monitor and address upcoming legislation. It also allows the association to continue to keep a number of attorneys on retainer for use of the organization and it’s members, including: Les Schneider, Esq., – Tax Advice; Michael Pepperman, Esq. – Employment and Labor Law Guidance; Poul Lemasters, Esq., Cremation Liability Phone Consultation & General Price List Compliance Check.

All donations to the ICCFA Government & Legal Fund go directly towards government & legal representation and support of the ICCFA. Businesses and individuals are eligible to donate to the ICCFA Government & Legal Fund and there is no annual donation limit.

Contribute

To contribute to the Government & Legal Fund, make your check payable to ICCFA, 107 Carpenter Dr, Ste 100, Sterling, VA 20164.

Please mention that your contribution is for the Government & Legal Fund.